5 Tips for Social Media Marketing for Fintech Companies

The social media landscape allows such a highly technological industry as fintech to use social media marketing to the fullest extent.

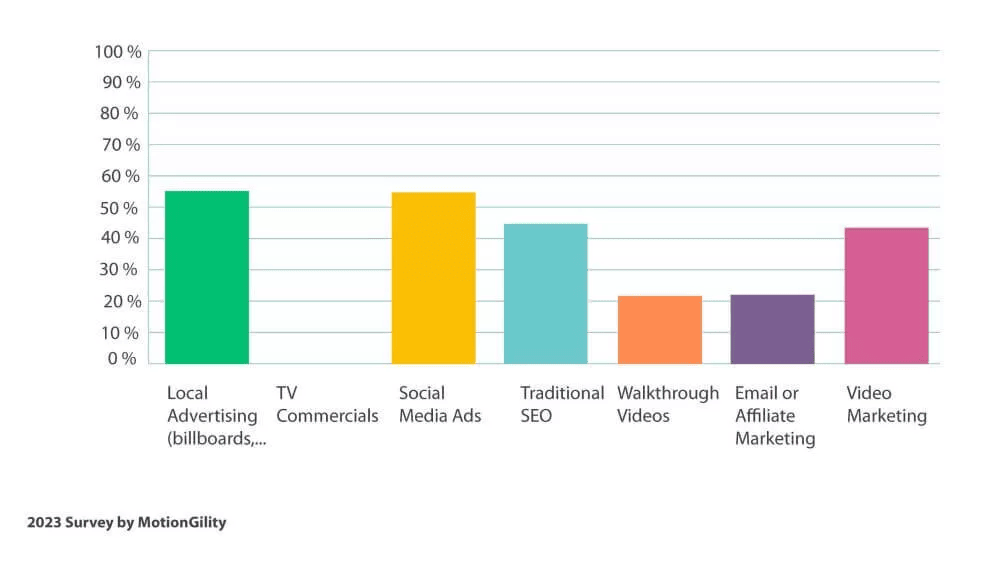

According to MotionGility and its survey on fintech video marketing, 55% of fintech companies utilize social media ads and billboards for customer outreach, and an average fintech product owner invests around 3,000 dollars in marketing monthly.

The digital nature of fintech solutions aligns perfectly with the online opportunities of social media platforms. It means using the power of social media analytics and marketing for brand awareness, innovation, creativity, and business promotion.

Chapters

Important Social Media Marketing Strategies for Fintech Businesses

We offer some practical strategic insights and tips here to help fintech companies navigate social media marketing successfully. Knowing the audience, choosing the right platform, and informing customers on brand-new fintech solutions are among the most obvious of them. You can also experiment and test new content formats, messaging strategies, and advertising tactics on social media.

Further on, we will discuss important areas such as understanding the fintech audience, crafting a compelling social media strategy, creating engaging content, utilizing influencer marketing, ensuring compliance and security, and other aspects.

Understanding the Fintech Audience

The target audience for fintech products is quite specific, so it is important to identify its key demographics and psychographics. The main demographic parameters should involve age, geographical location, income level, and educational level, including financial literacy. The basic psychographics criteria to be considered are the audience’s interests (technology, digital wallets, blockchain, etc.), values and beliefs that drive the financial decisions, behavior patterns (spending habits, saving tendencies, and investment strategies), and lifestyle choices (urban living, frequent travel, or a focus on family planning).

Successful social media marketing tactics also have to consider the analysis of preferred social media platforms. For example, LinkedIn is often favored by professionals and B2B audiences, while Twitter (X) is quite popular among tech-savvy users and those who are interested in real-time updates. Facebook works perfectly for creating community groups, sharing detailed posts, and running targeted ads. Instagram is popular among younger audiences who prefer visual storytelling, showcasing user-generated content, and ongoing brand aesthetics. YouTube is ideal for educational content.

You also have to consider the content consumption habits of your potential customers, such as their preferences for blogs and articles, videos and webinars, infographics and visual content, podcasts, polls, quizzes, and surveys.

If you analyze your audience’s preferences, it will help your fintech company to consider the specific needs for the effective development of social media marketing strategies.

Crafting a Compelling Social Media Strategy for Fintech Companies

For a start, a fintech company needs to establish clear and measurable goals for its social media efforts. Such goals and objectives may include:

- brand awareness;

- customer acquisition;

- customer engagement and retention;

- thought leadership;

- lead generation, etc.

After that, go over to developing a content plan that may involve educational, promotional, engaging, and inspirational content. For example, you may need to simplify complex financial concepts via block posts, explainer videos, infographics, and how-to guides.

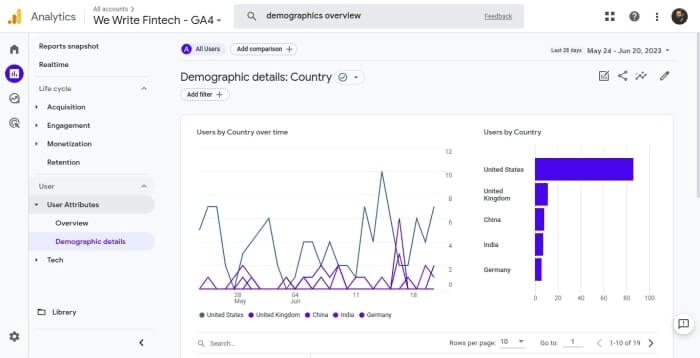

Make a content calendar that includes scheduling, frequency, and diversity of the content placed for marketing purposes. You also need tools for monitoring performance. Opt for instruments like Google Analytics, built-in analytic tools on social media platforms, such as Facebook Insights or LinkedIn Analytics, and third-party tools like Hootsuite, Sprout Social, and Buffer.

Your understanding of the key metrics to track, such as engagement rate, reach and impressions, click-through rate (CTR), conversion rate, follower growth, and sentiment analysis, will help find the most efficient ways for your fintech product promotion strategy.

Creating Engaging Content for Fintech Companies and Clients

When a fintech business focuses on educational, interactive, and user-generated content, it can captivate its audience, foster trust, and set up a loyal community.

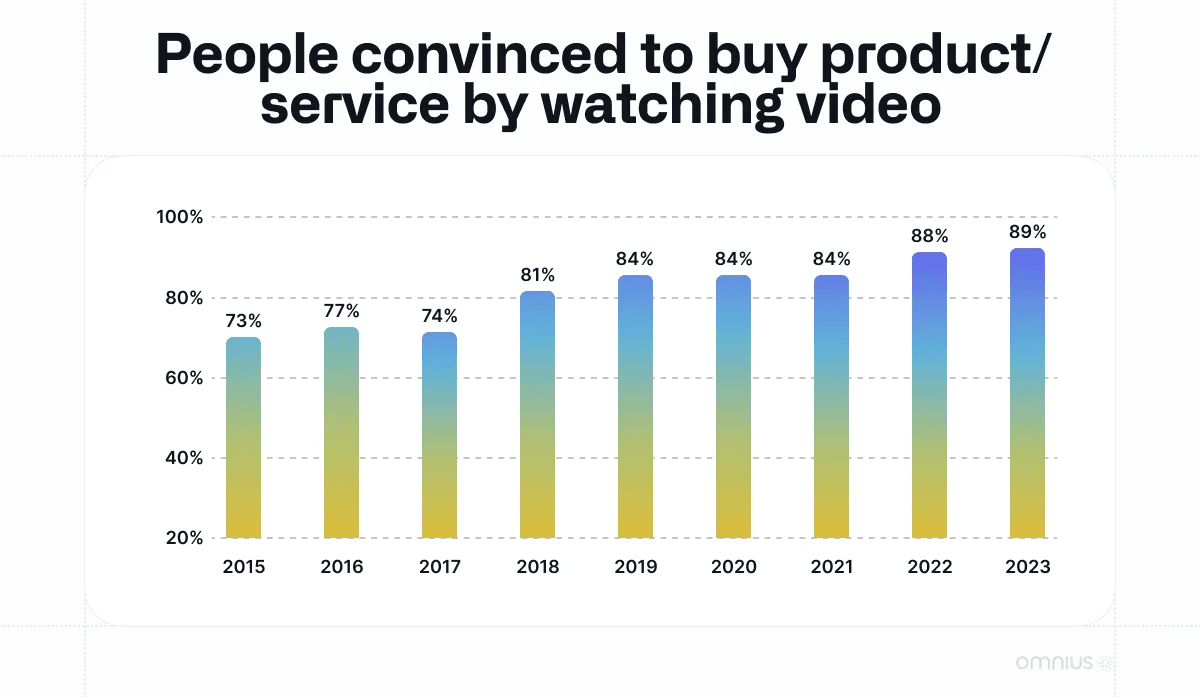

Educational content is meant to demystify complex financial concepts and help users to make informed decisions. The types of such content include blog posts and articles, explainer videos, infographics, e-books, and whitepapers. Such content builds trust, increases engagement, and drives traffic. Using a social media content generator is a great benefit. Its AI-powered capabilities will help you customize the fintech-related content to the needs of your customers.

According to Prabhath Sirisena, Co-founder & CPO of Hiveage, “Interactive content involves the audience by creating an engaging UX. Examples include polls and surveys, quizzes, Q&A sessions, live webinars, interactive infographics, and calculators. Interactive content provides enhanced engagement, insights, and boosted conversion rates. User-generated content (UGC) for fintech involves customer testimonials and reviews, case studies and success stories, social media mentions and shares, contests, and campaigns. UGC builds trust and authenticity, encourages community involvement, and extends the brand’s reach.”

Utilizing Influencer Marketing for Fintech Companies

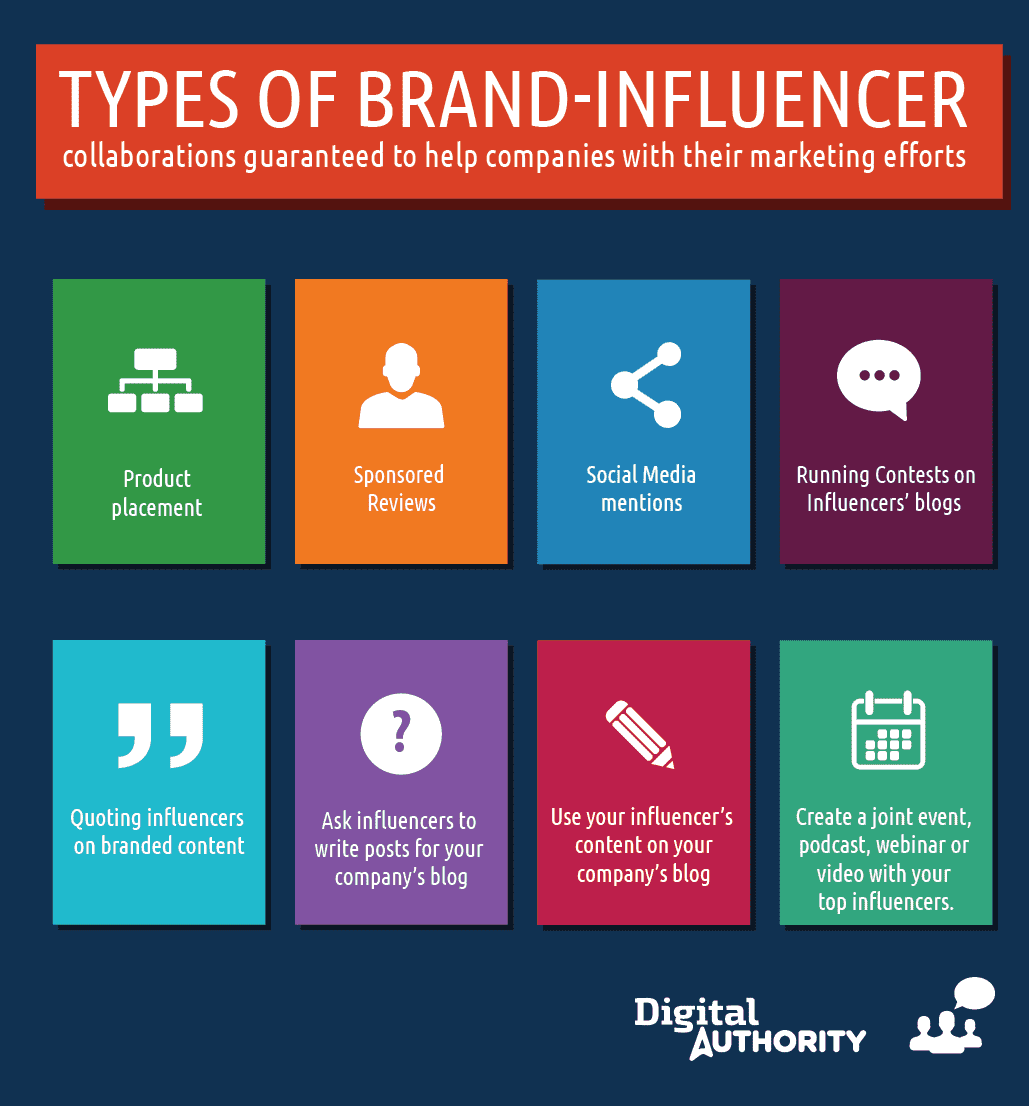

Influencer marketing is a valuable strategic solution for fintech companies. It can help them reach new audiences, build credibility, and enhance trust.

You can involve such types of influencers as finance or fintech industry experts, like financial advisors, economists, and industry analysts; thought leaders, such as founders of fintech startups, blockchain experts, and tech entrepreneurs; micro-influencers, such as personal finance bloggers, investment bloggers, and niche community leaders; and popular finance YouTubers, well-known financial authors, and media personalities.

When you select influencers for your fintech social media marketing, consider their relevance, high engagement rates, credibility, and content quality. Now, you need to build mutually beneficial partnerships with the chosen influencers. Research the influencers’ content and audience, highlight the benefits of collaborating with your fintech brand, work together to create content, ensure clear communication about your goals and expectations, aim for long-term collaboration and partnership, and measure the influencer marketing impact. Use social media and analytics, Google Analytics, influencer marketing platforms (Traackr, Upfluence, or Aspire IQ), surveys, and feedback to measure this influence.

Ensuring Compliance and Security in Social Media for Fintech Companies

Since the fintech industry always complies with regulations and guidelines, its social media marketing must safeguard customer data to maintain trust and avoid legal repercussions.

Here are some regulatory considerations that have to be thoroughly observed by a fintech business while conducting a marketing campaign on social media:

- All social media communications must comply with the FCA (Financial Conduct Authority), which is applicable in the UK.

- Any promotion that can be considered an investment recommendation must comply with SEC (Securities and Exchange Commission) regulations applicable in the USA.

- According to GDPR (General Data Protection Regulation) followed in the EU, companies must be transparent about data use.

- All communications must avoid deceptive practices and have to be clear and truthful about financial products and services, according to the US CFPB (Consumer Financial Protection Bureau).

The best practices for complying with these regulations involve clear disclosures of risks related to financial products, monitoring and approving content with automated tools and compliance software, staying updated on changes in regulations, and using achieving tools to store and manage social media content for audit purposes.

Further Practices Used in Fintech Social Media Marketing

You will also need to think about other effective practices for conducting social media marketing campaigns for your fintech company. They include:

- targeted ads;

- retargeting;

- using financial websites and apps;

- text-based ads;

- visual and video ads displayed within Google’s Display Network, YouTube, Facebook, or Instagram;

- native ads blended with the content on the platforms.

You will also need to build your fintech community on social media platforms and address customer feedback there immediately.

Final Thoughts

Key social media marketing tips for fintech companies include understanding the audience, crafting a compelling social media strategy, creating engaging content, utilizing influencer marketing, and ensuring compliance and security. You also need to consider leveraging paid advertising, engaging with your fintech community, and, of course, staying updated with trends.

By implementing these tips, your fintech company will manage to build strong connections with its audience, stay ahead of industry trends, and achieve growth and success. Start today by reviewing your current social media practices, identifying areas for improvement, and applying these tips to enhance your social media marketing efforts.

Maya Kirianova

Maya Kirianova is a freelance writer with a passion for crafting engaging content that spans various niches that range from technology to business. With a strong foundation in these industries, she delivers insightful and well-researched content that helps businesses and individuals navigate the complexities of the financial world.

Master the Art of Video Marketing

AI-Powered Tools to Ideate, Optimize, and Amplify!

- Spark Creativity: Unleash the most effective video ideas, scripts, and engaging hooks with our AI Generators.

- Optimize Instantly: Elevate your YouTube presence by optimizing video Titles, Descriptions, and Tags in seconds.

- Amplify Your Reach: Effortlessly craft social media, email, and ad copy to maximize your video’s impact.