Effective Social Media Content Ideas for Accountants [+ AI Tool]

Are you looking to Grow your Accountancy Firm on Social Media and in need of some Social Media Content Ideas? Check out our list below and our AI Tools to get the most out of your Social Media Marketing Efforts.

Why is Social Media Marketing important for Accountancy Firms?

Social media marketing is important for accountancy firms for several reasons:

Reach a wider audience: Social media platforms have billions of users worldwide. By leveraging these platforms, accountancy firms can reach a wider audience and promote their services to potential clients who may not have been aware of their existence otherwise.

Build brand awareness: Social media is a powerful tool for building brand awareness. By creating and sharing valuable content that educates and informs followers about accounting and financial topics, accountancy firms can establish themselves as experts in their field and build a strong brand reputation.

Engage with clients: Social media provides a way for accountancy firms to engage with clients and potential clients in real-time. This can help build relationships, answer questions, and address concerns.

Showcasing expertise: Social media platforms provide a great opportunity for accountancy firms to showcase their expertise and knowledge in a particular area. By sharing content such as case studies, white papers, and industry insights, firms can demonstrate their proficiency and attract clients seeking specialist services.

Stay top of mind: Regularly posting on social media platforms keeps accountancy firms top of mind for potential clients. By maintaining a consistent presence, firms can increase the chances of being remembered when a client needs accounting services.

Cost-effective marketing: Social media marketing is generally more cost-effective than traditional marketing methods. It provides an opportunity for firms to reach a large audience without spending significant amounts on advertising or other marketing campaigns.

Overall, social media marketing provides a powerful tool for accountancy firms to increase their visibility, build their brand, engage with clients, and ultimately attract new business.

Additional free resources:

AI Tools to help you come up with ideas and create cool Social Media Captions

At StoryLab.ai we’re committed to helping Accountants to become more effective by helping you tell more and better stories. We do that with our resources and with our tools.

- Our AI-Powered Social Media Post Idea Generator helps you come up with awesome new ideas.

- Our AI-Powered Social Media Caption Generator helps you take those ideas and turn them into social media captions in seconds

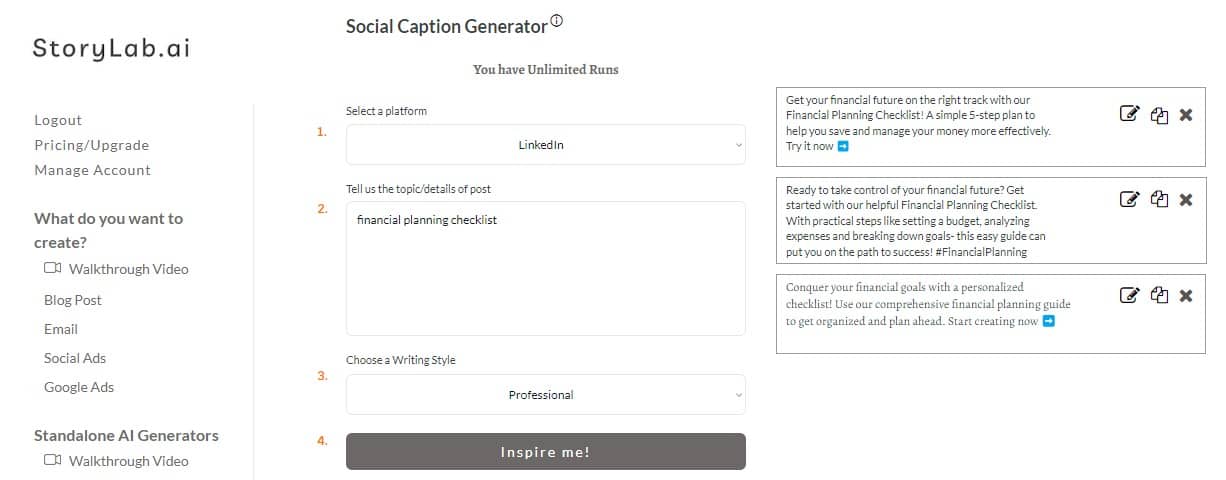

How the AI-Powered Social Media Caption Generator works

For this example, we’ve taken one of the social media content ideas below and entered it into our AI-Powered LinkedIn Caption Generator.

In the image below you can see what the AI Tool created for us in seconds:

LinkedIn Post Ideas the AI Tool Generated for us:

- Get your financial future on the right track with our Financial Planning Checklist! A simple 5-step plan to help you save and manage your money more effectively. Try it now ➡️

- Ready to take control of your financial future? Get started with our helpful Financial Planning Checklist. With practical steps like setting a budget, analyzing expenses and breaking down goals- this easy guide can put you on the path to success! #FinancialPlanning

- Conquer your financial goals with a personalized checklist! Use our comprehensive financial planning guide to get organized and plan ahead. Start creating now ➡️

Re-run the AI Tool if you need more inspiration, or take one of the captions, add your unique human touch, perfect it, and post it.

Grab a couple of social media ideas below, throw them into the AI Generator, and build your social media content calendar in minutes instead of days.

Effective Social Media Content Ideas for Accountants

- Create a financial planning checklist for the year ahead.

- Share an interesting financial news article and provide your thoughts on it.

- Offer tax tips for small business owners.

- Share your experience with a challenging tax case you worked on.

- Highlight a client success story and how you helped them with their finances.

- Offer advice on budgeting for a big life event, such as a wedding or home purchase.

- Share your favorite financial apps or tools.

- Provide a breakdown of a complex financial topic, such as retirement planning.

- Highlight a common tax deduction people often overlook.

- Share a motivational quote related to financial success.

- Offer tips for managing finances during a crisis.

- Share an infographic on the benefits of investing in a particular type of retirement account.

- Offer advice on preparing for tax season.

- Share your favorite financial book or podcast.

- Provide insight into how tax laws are changing and what it means for your clients.

- Share a story of a time when you had to navigate a difficult financial situation.

- Highlight a common financial mistake and how to avoid it.

- Offer advice on saving for college.

- Share a success story of a client who achieved their financial goals.

- Provide insight into how to negotiate a raise or promotion.

- Offer tips on how to create a budget that works for you.

- Share your thoughts on the current state of the economy.

- Provide guidance on how to build an emergency fund.

- Share a story of a time when you helped a client through a tough financial situation.

- Highlight the benefits of working with a financial advisor.

- Offer advice on how to make wise investment decisions.

- Share a story of a client who made a financial mistake and how you helped them recover.

- Provide guidance on how to prepare for retirement.

- Offer tips on how to reduce debt.

- Share an inspirational story of someone who achieved financial success against all odds.

- Highlight the benefits of using a financial planner.

- Offer advice on how to create a business plan.

- Share your thoughts on a new financial trend.

- Provide guidance on how to get out of debt.

- Offer tips on how to improve your credit score.

- Share a story of a client who achieved financial freedom and how you helped them get there.

- Highlight the benefits of diversifying your investments.

- Offer advice on how to create a financial plan.

- Share a motivational story of someone who overcame financial struggles.

- Provide guidance on how to save for a down payment on a house.

- Offer tips on how to start investing in the stock market.

- Share a story of a client who achieved a financial goal, such as paying off their mortgage.

- Highlight the benefits of creating a personal budget.

- Offer advice on how to handle a financial crisis.

- Share your thoughts on the best ways to save for retirement.

- Provide guidance on how to choose the right retirement account for your needs.

- Offer tips on how to build wealth over time.

- Share a success story of a client who started a successful business.

- Highlight the benefits of using a financial advisor.

- Offer advice on how to create a financial strategy for a small business.

- Share your thoughts on the best ways to invest in real estate.

- Provide guidance on how to choose the right financial advisor for your needs.

- Offer tips on how to create a successful investment portfolio.

- Share a story of a client who achieved financial independence.

- Highlight the benefits of creating a financial plan early in

- Share interesting statistics about the accounting industry.

- Share tips for preparing for tax season.

- Share updates on changes to tax laws and regulations.

- Share advice on how to save money on taxes.

- Share information on how to set up a budget.

- Share information on how to save money for retirement.

- Share information on how to manage debt.

- Share information on how to improve credit scores.

- Share information on how to avoid common accounting mistakes.

- Share information on how to file taxes for small businesses.

- Share information on how to prepare for an audit.

- Share information on how to improve financial literacy.

- Share information on how to invest in stocks.

- Share information on how to start a business.

- Share information on how to sell a business.

- Share information on how to value a business.

- Share information on how to merge two businesses.

- Share information on how to acquire a business.

- Share information on how to manage payroll.

- Share information on how to manage cash flow.

- Share information on how to prepare financial statements.

- Share information on how to prepare financial forecasts.

- Share information on how to manage taxes for freelancers.

- Share information on how to manage taxes for remote workers.

- Share information on how to manage taxes for international workers.

- Share information on how to manage taxes for non-profits.

- Share information on how to manage taxes for charities.

- Share information on how to manage taxes for religious organizations.

- Share information on how to manage taxes for political organizations.

- Share information on how to manage taxes for schools.

- Share information on how to manage taxes for universities.

- Share information on how to manage taxes for hospitals.

- Share information on how to manage taxes for government agencies.

- Share information on how to manage taxes for military personnel.

- Share information on how to manage taxes for retirees.

- Share information on how to manage taxes for families.

- Share information on how to manage taxes for individuals.

- Share information on how to manage taxes for high-net-worth individuals.

- Share information on how to manage taxes for estate planning.

- Share information on how to manage taxes for trusts.

- Share information on how to manage taxes for inheritance.

- Share information on how to manage taxes for gifts.

- Share information on how to manage taxes for property sales.

- Share information on how to manage taxes for rental properties.

- Share information on how to manage taxes for capital gains.

- Share information on how to manage taxes for dividends.

- Share information on how to manage taxes for interest.

- Share information on how to manage taxes for investments.

- Share information on how to manage taxes for cryptocurrencies.

- Share information on how to manage taxes for NFTs.

- Share information on how to manage taxes for digital assets.

- Share information on how to manage taxes for intellectual property.

- Share information on how to manage taxes for patents.

- Share information on how to manage taxes for trademarks.

- Share information on how to manage taxes for copyrights.

- Share information on how to manage taxes for royalties.

- Share information on how to manage taxes for licensing.

- Share information on how to manage taxes for franchising.

- Share information on how to manage taxes for leasing.

- Share information on how to manage taxes for financing.

- Share information on how to manage taxes for loans.

- Share information on how to manage taxes for mortgages.

Social Media Tips for Accountants

For accountants looking to elevate their presence on social media, the approach needs to blend professionalism with personality. Utilizing social media effectively can not only showcase your expertise but also build trust with current and prospective clients. Here are some tailored social media tips for accountants, peppered with creative social media ideas to set you apart in the financial industry.

Create Educational Content

One of the most valuable social media ideas for accountants is to produce content that educates your audience about financial literacy, tax updates, and best practices in money management. Break down complex financial concepts into digestible, engaging posts or videos. This positions you as an expert and a go-to resource.

Share Client Success Stories (with Permission)

With client consent, share success stories that highlight how your services have helped businesses or individuals achieve their financial goals. This not only provides social proof but also humanizes your brand, showing the real-world impact of your work. Ensure confidentiality and compliance with all relevant regulations when sharing such stories.

Leverage LinkedIn Effectively

For accountants, LinkedIn can be a goldmine. Share thought leadership articles, industry insights, and participate in relevant groups. Use LinkedIn to network with peers and potential clients, and don’t shy away from engaging in discussions or sharing commentary on trending financial news.

Host Live Q&A Sessions

Schedule live sessions on platforms like Instagram, Facebook, or LinkedIn, where you answer common financial questions. This interactive format not only boosts engagement but also allows you to showcase your expertise in real-time, making financial advice more accessible.

Utilize Infographics and Visual Data

Financial data can be dense and difficult to parse. Simplify this information through infographics and visual posts that make trends, data analysis, and statistics easy to understand at a glance. This type of content is highly shareable and can help demystify the complexities of finance.

Incorporate Video Content

Videos, especially short ones, can significantly increase engagement. Create video content that ranges from office tours to explainer videos on tax changes, financial tips, or software tutorials. This adds a dynamic layer to your content strategy and caters to users who prefer video over text.

Highlight Your Firm’s Culture

Showcase your firm’s culture and team to build a more personal connection with your audience. Share behind-the-scenes glimpses of your office life, team outings, or community service projects. This social media idea helps humanize your brand and makes it more relatable.

Offer Exclusive Social Media Discounts

Attract new clients by offering exclusive discounts or consultations for your social media followers. This not only rewards your followers but also incentivizes new clients to engage with your social media profiles.

Collaborate with Non-Financial Influencers

Team up with influencers or professionals outside the finance industry for a fresh take on financial planning and management. This could involve a lifestyle blogger discussing budgeting for home decor or a travel influencer covering how to save for vacations. Such collaborations can introduce your expertise to a wider, diverse audience.

Stay Updated and Relevant

Finally, always stay on top of the latest financial news and trends. Use your social media platforms to comment on how these changes could affect your audience. Being a source of current, relevant information reinforces your value to your followers.

By incorporating these unique social media tips and ideas, accountants can effectively engage their audience, demonstrate their expertise, and build a trustworthy brand online. Remember, the key is to balance professional insights with personal touches that resonate with your audience.

Master the Art of Video Marketing

AI-Powered Tools to Ideate, Optimize, and Amplify!

- Spark Creativity: Unleash the most effective video ideas, scripts, and engaging hooks with our AI Generators.

- Optimize Instantly: Elevate your YouTube presence by optimizing video Titles, Descriptions, and Tags in seconds.

- Amplify Your Reach: Effortlessly craft social media, email, and ad copy to maximize your video’s impact.

Looking for more Social Media Content Ideas? Check out.

- Social Media Content Ideas for Accountants

- Airline Social Media Content Ideas

- Christmas Social Media Content Ideas for Companies

- Social Media Content Idea Automotive Brands

- Effective Crypto Social Media Content Ideas

- Effective B2B Social Media Content Ideas

- Electrician Social Media Content Ideas

- Gardening Social Media Content Ideas

- Banking Social Media Content Ideas

- Social Media Content Ideas for Businesses

- E-Commerce Social Media Content Ideas

- Effective Food Social Media Content Ideas

- Effective Fitness Social Media Content Ideas

- Real Estate Social Media Content Ideas

- Effective Startup Social Media Content Ideas

- Environmental Social Media Content Ideas

- Social Media Comtent Ideas for Landscapers

- Social Media Content Ideas for Roofers

- Effective Travel Social Media Content Ideas

- Pest Control Social Media Content Ideas

- Plumber Social Media Content Ideas

- Social Media Content Ideas for Nonprofits

Or, check out all other examples like Blog Intros, Google and Facebook ad copies, and more.

Write great Social Media Captions in half the time

There is nothing worst than staring at a blank piece of paper. StoryLab.ai’s Marketing Copy Generators help you to get new ideas and even complete copy with a click of a button.

Get inspired by how many different ways there are to describe your blog titles, Instagram captions, ad copy, and more. Next to generating new ideas and creating new copy, you can reword existing copy with our AI Paraphrase Generator, extend your copy with our AI Text Extender, and more.

Our Marketing Copy Generators run on GPT-4. Trained, as the largest and qualitatively best Natural Language Processing model. Check out our resource hub and see how AI Marketing can help you reach your goals faster. The time to start using this new technology is now.